BSc (Hons) in

Finance

From banking and investments to accounting and portfolio management, you’ll develop the expertise to launch a successful career in one of the world’s most dynamic industries.

WIUT Business School

COURSE OVERVIEW

BSc (Hons) Finance course is designed to equip you with the essential knowledge and skills to succeed in the ever-evolving world of finance. Through a combination of theoretical learning and practical application, you will explore areas such as banking, investment, accounting, insurance, portfolio management, and much more.

The course is designed with your future career in mind, ensuring that you develop a robust understanding of the financial landscape. By incorporating professional standards such as those set by ACCA alongside emerging trends such as sustainable finance, you will be prepared to excel in diverse roles across the financial sector.

This programme emphasises the integration of finance principles with real-world applications, preparing you to navigate the complexities of international financial markets and institutions. By focusing on key themes such as sustainable and ethical finance and offering exposure to state-of-the-art tools like the Financial Market Suite (FMS), you will gain practical experience through each level of study. The course is structured to ensure that by the time you graduate, you will have mastered essential concepts, demonstrated the ability to apply them to real-world financial problems, and developed both the technical and transferable skills needed to thrive in the finance industry.

WHAT YOU NEED TO KNOW

Award Title

Bachelor of Science (Hons)

Start Date

September (each academic year)

Duration

3 years (full time)

Tuition Fees

Domestic - 36,292,800 UZS /per year

International - 54,600,000 UZS /per year

HOW YOU WILL STUDY

The course uses a blend of dynamic and interactive learning methods designed to engage students and foster a deep understanding of financial and accounting principles. Emphasised as a cornerstone of the learning experience, independent study challenges students to engage in various activities such as research, project work, and preparation for assessments. This approach encourages the development of critical thinking and problem-solving skills essential for professional success.

Students are encouraged to collaborate in groups during seminars and workshops. This collaborative environment facilitates the sharing of ideas and perspectives, enhancing learning outcomes and preparing students for team-oriented work settings. Course materials and communication channels are provided through an online learning platform, accessible anywhere with internet connectivity.

Lectures delivered both in-person and virtually, offer foundational knowledge and theoretical frameworks, while seminars allow for interactive discussions and problem-solving activities to apply concepts learned in lectures.

Workshops, particularly in computer labs and financial markets suites, provide hands-on experience with financial tools and software, enhancing technical skills

- Year 1 (Level 4): 100 core credits + 20 credits of optional/elective modules focus on developing foundational skills in interpreting financial statements, applying statistical methods, and understanding economic principles, all of which provide a strong basis for further learning.

- Year 2 (Level 5): 60 core credits + 60 credits of optional/elective modules will help you advance your understanding of quantitative methods and financial decision-making, equipping you with the technical skills necessary to tackle more complex challenges in finance.

- Year 3 (Level 6): 60 core credits + 60 credits of optional/elective modules will refine your abilities to analyse data, critique financial strategies, and propose informed solutions, while also developing skills in data analysis to handle complex financial tasks. Throughout the learning process, students are encouraged to think critically, engage with practical applications, and prepare for professional roles in finance.

COURSE STRUCTURE

Please note: Not all option modules will necessarily be offered in any one year. In addition, timetabling and limited spaces may mean you cannot do your first choice of modules.

WHY CHOOSE FINANCE AT WIUT?

Build a strong foundation in finance – the course equips you with a comprehensive understanding of the financial sector and its role in the global economy.

Apply knowledge in real-world contexts – through financial simulations, trading games, and case-based workshops.

Strengthen your technical expertise – gain skills in financial modelling, risk assessment, and strategic planning, preparing you for roles in investment banking, corporate finance, and financial consultancy.

Learn from international experts – academic team combines research excellence and industry experience, while visiting practitioners bring insights from leading banks, consultancy firms, and multinational corporations.

Experience cutting-edge resources – industry-standard tools, including the Bloomberg Lab and financial analysis software, bridging the gap between classroom learning and professional practice.

Skills-focused approach – designed to develop the skills employers value most ensuring you stand out in a competitive job market.

Professionally aligned – benefit from modules mapped to the requirements of ACCA, CIMA, CFA Level 1, and CII, giving you exemptions and a head start towards professional certifications recognised worldwide.

EXTERNAL ENGAGEMENT

Visiting Practitioner Teachers. You will be taught by active finance professionals: bankers, investment analysts, risk managers, auditors, who bring contemporary market insights into your learning.

Guest Lectures & Industry Workshops. Regular lectures, panel sessions, and workshops led by industry experts extend your classroom experience. These events give you exposure to current challenges, trends, and innovations in finance, allowing you to ask questions, explore real-case scenarios, and build a network of professional contacts.

Curriculum Responsiveness. Because practitioners help shape what is taught, the curriculum stays aligned with market demands. Tools like the Financial Market Suite (FMS) are used, and content evolves in response to regulatory change, emerging technologies (FinTech, AI), sustainable finance / ESG, global market disruptions, and ethical considerations.

ASSESSMENT METHODS

Modules have authentic assessment methods, such as projects, case studies, and practical assignments, aim to replicate real-world tasks, giving students the opportunity to apply theoretical knowledge in practical settings. These assessments are designed to mirror workplace challenges, encouraging critical thinking, problem-solving, and decision-making. For instance, students may be tasked with analyzing financial data, creating business reports, or developing strategies for financial decision-making, all of which simulate professional tasks.

ACCA-accredited modules have a specific focus on aligning assessment methods with the exam formats used by ACCA. This alignment ensures that students are well-prepared for their professional qualifications by practicing the types of assessments they will face in their ACCA exams. Successfully completing these modules may grant students exemptions from corresponding ACCA exams, helping them progress toward their professional accreditation.

ENTRY REQUIREMENTS

We are committed to delivering a professional, fair, and transparent admissions process that ensures equal opportunity for all applicants. Our aim is to connect students with courses that align with their goals and their ability to meet academic and professional standards. Find out more Admissions policy and Terms and conditions.

-

Applicants should satisfy at a minimum one of the following requirements:

- Successful completion of an appropriate International Foundation course; or

- Successful completion of the first year of an appropriate degree course in a recognised Uzbek or similar university; or

- Two GCE A level passes (only subjects directly relevant to the field of study applied for. The University reserves the right to assess the suitability of subjects presented and to determine their alignment with programme entry requirements), plus three GCSE passes at grade C or above including English Language and Mathematics; or NC/ND or HNC/HND. The range of academic disciplines studied is not hereby restricted, but certain vocational courses such as City and Guilds would not satisfy the admissions requirements; or

- An Advanced General National Vocational Qualification (GNVQ); or

- Any other equivalent qualification normally accepted as entry requirement (e.g. International Baccalaureate, etc.).

-

Applicants must have:

- Completed their secondary education in English and achieved Grade C or above in the equivalent GCSE English exam; or

- IELTS score of 6.5 with a minimum of 6.0 in the writing component; or

- Successfully completed an appropriate International Foundation course with a "pass" in an Academic English module.

We accept the TOEFL (IBT (In person test) for entry to our programmes. We also accept TOEFL ‘My Best Scores’ where it relates to TOEFL iBT test results.

Please note that the TOEFL Home Edition (Online test) is not accepted for entry to WIUT degree programmes.

- TOEFL should be 85 overall with a minimum of 22 in Writing

-

Age requirements

Applicants will have to be 18 years of age at the start of the academic year. For the purposes of this regulation, the academic year runs from 1st October to 30th September of the following year.

Applications are normally processed based on the documentation submitted on the WIUT admissions system. The University reserves the right to introduce other admission processes such as an interview.

-

Applicants must have an acceptable level of competence in Mathematics. This could be demonstrated by one of the following:

- A "pass" in a maths test approved by the University of Westminster (UK); or

- Grade C or above in GCSE/’O’ Level Mathematics (or its equivalent); or

- SAT mathematics component 570; or

- Successful completion of an appropriate International Foundation course with "pass" in Quantitative Methods module.

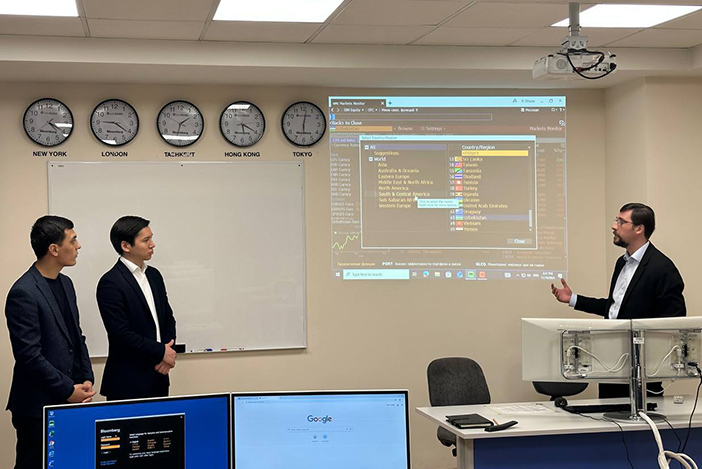

BLOOMBERG LAB

WIUT is the first university in Uzbekistan to provide students with access to the Bloomberg Terminal - the world’s leading platform for real-time financial data, news, and analytics.

With the Bloomberg Terminal, WIUT students can:

Process international real-time finances accurately;

Track stock markets, foreign exchange, and commodities;

Construct and validate investment strategies;

Obtain certifications like Bloomberg Market Concepts (BMC), Bloomberg Environmental Social Governance Certificate (ESG), Bloomberg Finance Fundamentals (BFF), Bloomberg Spreadsheet Analysis.

By integrating Bloomberg technology into the BSc (Hons) in Finance and related programmes, WIUT ensures that graduates develop the practical skills, analytical mindset, and professional edge demanded by employers in today’s competitive job market.

RECENT ACHIEVEMENTS

Our Finance students consistently demonstrate their ability to compete and win on the global stage.

In the Bloomberg Global Trading Challenge 2021, a team of five Finance students ranked 14th worldwide and 4th in Asia, outperforming 495 universities. This marked Uzbekistan’s first appearance in the competition, placing 5th globally by country and making WIUT the only CIS institution in the top 100.

Continuing this success, in the Bloomberg Global Trading Challenge 2024, WIUT expanded its presence with 34 students across 8 teams, competing against over 13,000 students from 2,520 teams worldwide. Our top team, DT Capital, placed 39th globally (top 1%), 1st in Central Asia, and 4th in Asia by country.

BSc Economics with Finance and BSc Finance students have also excelled in the CFA Institute Research Challenge, winning the Central Asia round three times (2019, 2020, and 2023). In 2023, our team became sub-regional winners in Kazakhstan and advanced to the Regional Semifinals for the first time, competing against 138 top universities from Europe, the Middle East, and Africa.

The WIUT team — Muzaffar Zokirov, Rustam Zabirov, Orifjon G’ulomov and Mirabzal G’uzorov — won 1st place in the inaugural Uzbekistan Future CFO University Students’ Competition, organised by ACCA with the support of the Ministry of Economy and Finance of the Republic of Uzbekistan. Competing in four challenging rounds across three languages, our students showcased exceptional analytical, financial and leadership skills, securing the top prize of 20,000,000 UZS. Recognising their talent and potential, all four team members received job offers from KPMG, a strategic partner of the competition and one of the world’s top professional services firms.

OUR GRADUATES WORK AT

CAREERS

With a BSc in Finance, you’ll be ready to start building a career in commercial, investment, and savings banks; help businesses, individuals, and public organisations make sound financial decisions; and work in the finance departments of corporations, nonprofit institutions, and governmental agencies. The knowledge you gain in class forms the foundation for your finance career which you begin building well before graduation:

Modules aligned with ACCA and CII syllabus, and incorporates topics from CIMA and CFA Level 1 studies;

Exemptions toward professional certifications in finance and accounting;

Support from WIUT’s Career Development Centre for internships, networking, and recruitment by top firms, including the Big 4.

Graduates can pursue roles such as: Financial Analyst, Risk Analyst, Investment Analyst / Banker, Corporate Banker, Credit Manager, Equity Researcher, Treasury Specialist, Stockbroker, Corporate Finance Specialist.

Your professional network will grow beyond the classroom. As a Finance student, you’ll have the chance to participate in student-led societies, industry-focused clubs, and special initiatives that connect you with peers, alumni, and professionals. These opportunities provide not only networking but also access to workshops, case competitions, and scholarships that enhance your academic journey and prepare you for success in the global financial sector. With access to leading employers and internship opportunities, our students gain valuable exposure to the professional world of finance.

COURSE LEADER

Feruza is a Ph.D. candidate at the University of Westminster (UK). She is doing her Ph.D. in Finance and her research area is Banking and Profitability.

Before joining Westminster International University in Tashkent, she was a researcher at the National research center. She also liaised projects with UNDP, Konrad Adenauer, and FES. Her present job is to play an important role in the management, planning, and operations of running the Finance course and enhancing the overall student learning experience.

TAUGHT BY TEAM OF EXPERTS

WHAT OUR GRADUATES SAY

Boston Consulting Group, Tashkent, Uzbekistan

LLC KPMG Valuation and Consulting — Senior Consultant, Investment and Capital Markets Department / Associate, Deal Advisory Department

Graduate of MSc Business Analytics program, Budapest, Hungary

TAKE THE NEXT STEP

Are you considering Westminster International University in Tashkent but unsure where to begin?

Our admissions counsellors are available to assist you. Have all your queries addressed to make an informed decision about your future.

RELATED PROGRAMMES

MSc in

Applied Economics

Gain knowledge of economic theory and practice. Build skills for policy and consultancy.

BSc (Hons) in

Economics and its Pathways

Develop skills in economics, finance and data science for policy and business.